PlaceTech interview CEO Marcus Ginn about "why real estate needs data-heavy maps"

At the end of February Karl Tomusk from PlaceTech sat down with our CEO Marcus Ginn to learn more about our business. We are pleased to share with you the full interview, which was also the headline story for their weekly newsletter.

Edozo likes to keep things simple. At its core, the mapping and research startup exists simply to help real estate professionals understand the value of assets more quickly and accurately. The company has three products:

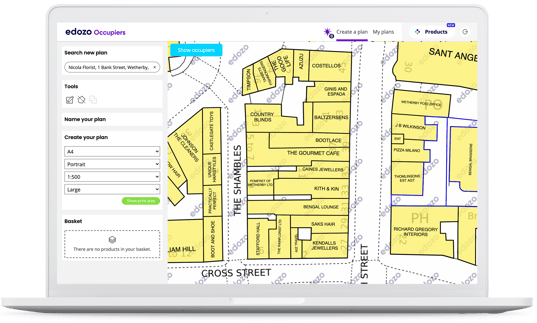

- Edozo Maps: A mapping tool that allows users to overlay any number of data layers onto a property boundary map. A key selling point is its auto-polygon feature with which users can create custom boundaries “in seconds”

- Edozo Occupiers: A cross-sector commercial real estate occupier mapping product, simply showing retail, leisure, industrial and office occupiers in a given area

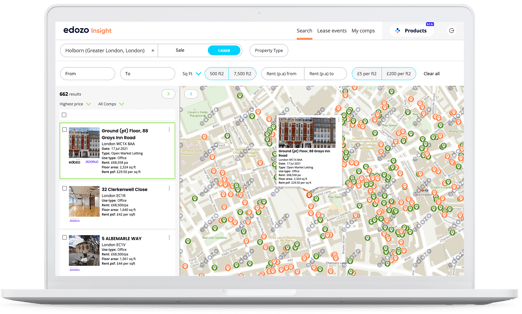

- Edozo Insight: Provides transaction data, bringing together a range of sources, including Land Registry, in-house research, client data and external data partners that collect “large volumes” of commercial real estate data

“Sitting above each of the individual products is an overarching aim, which is to improve the experience of research and valuing commercial property – make it easier, faster and more accurate,” Ginn says.

For example, using an occupier map, a retail agent will be able to gauge how appropriate a specific street is for a client. “So if I’m Boots the chemist, and there’s a Superdrug on the same parade, that’s a pretty good indication that it’s a useful pitch for me.” Someone valuing space on an industrial estate can make a better judgement with complete occupier data.

This sounds really simple. Why does simplicity matter?

The first thing people want is simplicity, Ginn says. The asset class is complex, as is a lot of the tech available. But people want a simple tool that does what they need it to – and often that is simply to save time and money.

“[Users] know they need to find efficiency in their roles: A, to better serve the customers who want shorter lead times for any piece of advice [they] provide, and B, to support margins,” says Ginn.

“Valuing commercial property, it’s a constant race to be as efficient as possible to keep that a positive margin activity.”

But that simplicity is deceptive. Behind the simple interfaces is a data team constantly collecting data and ensuring it’s as accurate as possible.

Ginn says: “The clever part has been aggregating various different digital data sources to present over a million commercial occupiers across the UK, accurately in the right buildings – and then with the right degree of aesthetic quality so that customers can go in, produce a plan of any size they need and put that into a marketing brochure or evaluation report.”

What is the benefit of data aggregation for average industry users?

This comes back to efficiency. “It takes days or weeks to value a property,” says Ginn. “The starting point is aggregating the information. In the old days – as in, pre-Edozo – you could have been using over a dozen websites to research the information. We want to bring as much of that research into one hub as possible.”

Surely there are limits to how accurate all this data is?

Ginn says that historically, data providers in real estate have over-promised and under-delivered. They might claim to have “perfect market knowledge”, but often they fall short.

“We don’t claim that we’re providing perfect, UK-wide, complete information,” Ginn says. “We do claim to have huge volumes of very useful data that play a really important role in the sector.

“For many companies it’s all they need, and for others, it’s a really useful addition to the data sources they’re already using.”

How do you meet the needs of both SMEs and real estate giants?

Despite having several large clients – JLL, CBRE, BNP Paribas, Allsop, among others – Edozo also wants to cater to smaller businesses. This means users can choose how much data they want.

A national agent might want access to all occupier data across the country to help clients in any part of the UK, but a regional agent might only want access to Greater Manchester, for example. The price, therefore, is flexible.

“We want everyone working in the commercial property sector to be able to feel that good quality tech and data is in their reach, when at the moment, particularly a lot of the SME firms serving the sector feel priced out of some product categories,” Ginn says.

What’s next for product development?

While the focus in recent years has been on aggregating data, he says the next step is automation: “There are different types, different degrees of analysis you want to apply to the data depending on your use case. Our mission going forward from here is to make that analysis as simple as possible.”

Edozo plans to launch analytics and desktop valuation tools within its Insight product over the next few months. What does that mean? “If you don’t want to go and do a really deep valuation exercise on assets, you can use those tools on the application to very quickly arrive at an estimation of the valuation of the asset,” Ginn says. Sounds simple – but that’s the way Edozo likes it.

---

Read the article in full here.